Insurers need to implement IFRS 17 in 2022 and this standard contains different measurement models, important guidelines and new definitions. We will summarize the basics of grouping and the different measurement models in this article.

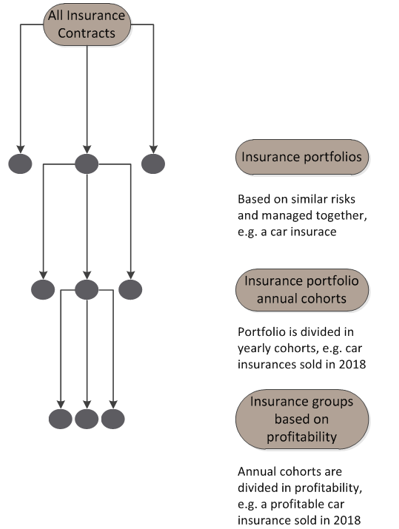

The IFRS 17 grouping:

Insurers need to disclose information bases on group of contracts. A group is a managed group (often a product) of contracts which were al profitable, onerous, or may become onerous (decided at inception) with a certain inception year. An expected profitable car insurance started in 2018 is an example group. Insurance companies can have hundreds of groups and IFRS 17 insisted on this grouping in order to have more transparency as insurance companies cannot offset the result of one group to another.

IFRS 17 Definitions:

In order to explain the measurement models it is important to first highlight the main definitions

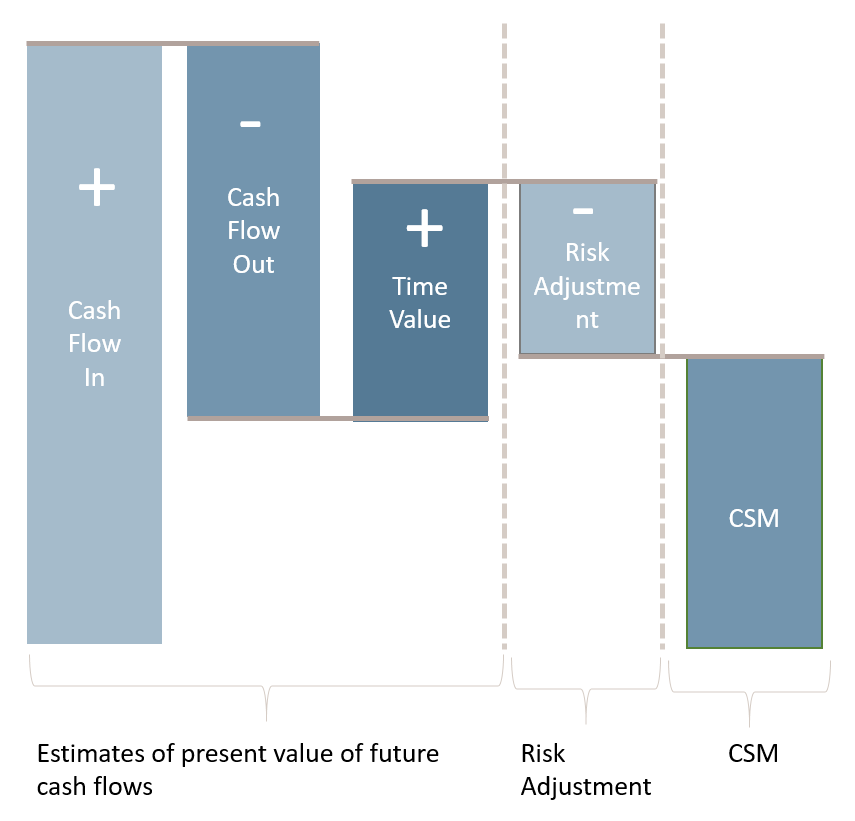

- Expected cash flows: the expected cash flows the insurance company expects to get and pay. The expected cash flows are calculated among different unbiased scenarios, taking into account different cash flows like expenses, claims, premiums etc.

- Discount rate; the expected cash flows are discounted with the discount rate which reflect the time period and the financial risk of the contract.

- Risk Adjustment: the money the insurer wants to get on top of the cash flows in order to take the uncertainty of the insurance contract. So this is for the insurance risk, the non-financial risk.

- CSM: contributional service margin. The expected unearned profit of a contract. So more or less the profit we expect to make if our assumptions hold. This is the money which is left if we take the expected cash flow in – expected cash flow out – risk adjustment. If this total is negative then we have a loss component instead of the CSM, this holds for onerous contracts.

IFRS 17 Measurement models

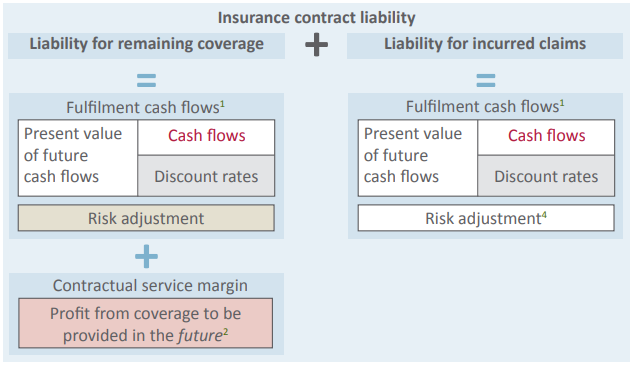

The General measurement model (GMM) or Building Block approach. (BBA)

The standard approach. You calculate the expected discounted cash flows, risk adjustment and the remaining CSM or loss component and you put this on the balance. Expected loss onerous contracts need to go directly through P&L. Every year you update your assumptions and the amounts for the expected cash flows, risk adjustment, CSM and loss component. Positive or negative changes can go through CSM, P&L or can hit the own funds directly. Once we delivered the insurance service then part of the CSM will go through the P&L resulting in a profit. At inception no profit can be made!

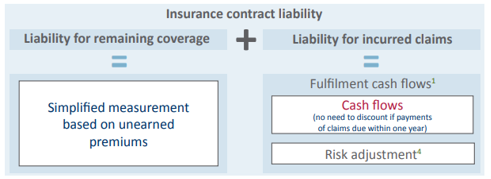

The Premium allocation approach (PAA)

Simplified approach which you may only use when contracts are at inception onerous, or when the coverage period is smaller than one year or when the insurer can show that the result of the PAA is no different than the GMM. The way of calculating the insurance liability once a policy holder has indicated a claim is not different, the only difference is for the coverage period. With PAA there is a simplified method, comparable with how insurers currently do, while with GMM are the cash flows, discounting, risk adjustment and CSM calculated.

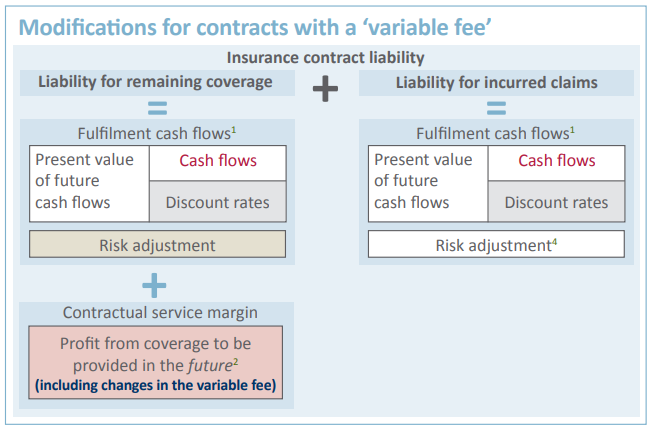

The Variable fee approach (VFA)

Comparable to GMM, only difference is that this group of insurance contract have policy holders who participate in share of clearly identified pool of underlying items. The insurer expects that part of the profit of the underlying items needs to be paid to the policy holder, while the amount paid to the policy holder depends on the underlying item. The result is that VFA looks like GMM, not different at the start of the contract. Only the subsequent years there are differences in the cash flows (as part goes to policy holder) and the CSM does not reflect the unearned profit for the insurer, as part of it also belongs to the policy holder.