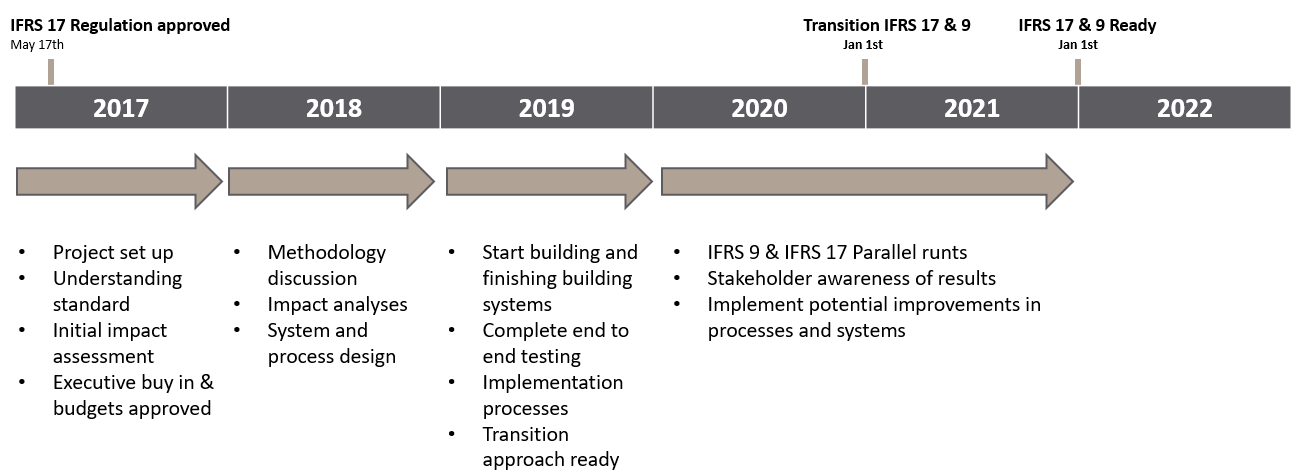

Official implementation process

IFRS 17 is effective from the beginning of 2022 (taking into account the year delay) which means you have to report IFRS 17 numbers from the quarterly reports from Q1 2022. Not every company has Quarterly reports, but if the insurer does have quaterly reports and discloses under IFRS 17 then that is the first time you have to present numbers in IFRS 17. This is often still a limited set of data, which increases with the H1 report of 2021 while in 2022 when the financial results of 2021 are presented and compared with 2020 then the transition has completely taken place.

In Practice

IFRS 17 is a big change so many insurers will do a dry run before, depending on the comfort they have with the numbers. There are insurers who want to be ready a year in advance and do a dry run over the complete 2020 financial statement, while others may choose for the big bang approach and wait till the latest moment. This is a trade-off between certainty and cost; the earlier implementation and extra dry run will cost extra, but will also give extra certainty when the company really starts presenting in IFRS 17.