Insurers need to disclose information regarding the balance sheet, income statement, changes in equirty, cash flow statement and extra explanatory information. IFRS 17 has impact on all parts, here we will focus on the balance sheet, income statement and changes in equity

Balance Sheet

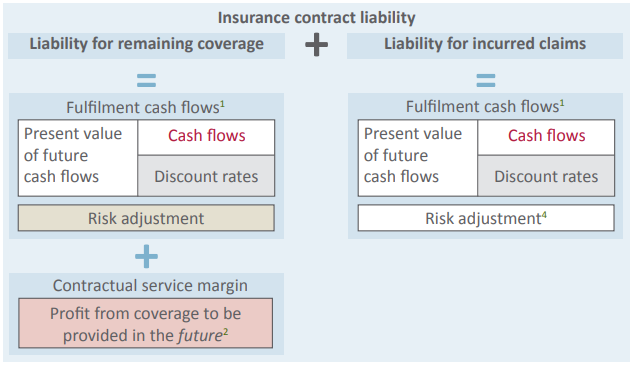

The presentation of the consolidated balance sheet will often only have minor changes; the insurance assets and insurance liabilities need to be splits (right now they can be aggregated), same holds for the reinsurance part. The biggest difference is in the specification of the insurance liability which is on the consolidated balance sheet:

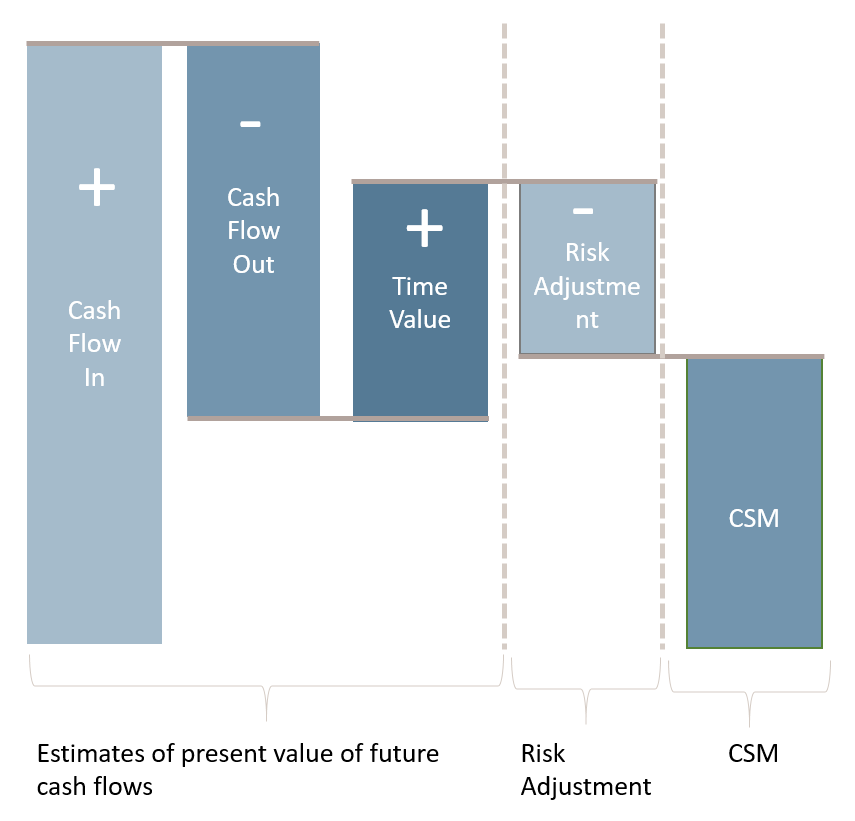

- The insurance liability is split into expected cash flows, risk adjustment, CSM and loss component. While a specification of insurance liability into coverage and claims amount is also needed

- The insurance liabilitiy needs to be specified on the models being used (the General Measurement Model, the Premium Allocation Approach and the Variable Fee Approach) or the type of transition model: the Fair Value Approach, the Modified Retrospective Approach or the Full retrospective approach / regular contracts.

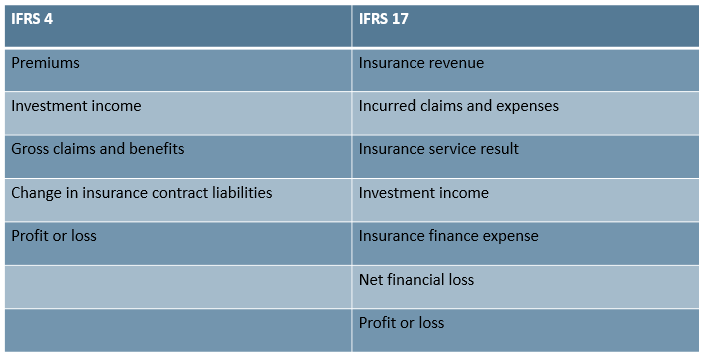

Income Statement:

The presentation of the income statement also changes minorly, but the change is important. Written premiums are not important anymore it is now about services provided. So earned premiums are replaces by service income and service expenses. As the name implies the income and expenses connected to the services which the insurer has provided in the period. Also for the income statement will the specification change largely:

- Specification whether the service income and expenses are connected to a service which was delivered in the past, current period or even future period

- Just like the balance sheet do we also have to divide the changes of the insurance liability into Fair Value Approach, the Modified Retrospective Approach or the Full retrospective approach / regular contracts.

Changes in Equity

As stated does the presentation of solely the consolidated income statement and the balance sheet not change dramatically, but the numbers can. The Balance sheet can now still be constructed based on old assumptions and with IFRS 17 these assumptions need to be updated and can therefore impact the insurance liability and with this the connected equity. Under IFRS 17 it is allowed to shows this equity hit in the first financial statement which is presented using the IFRS 17 standard.