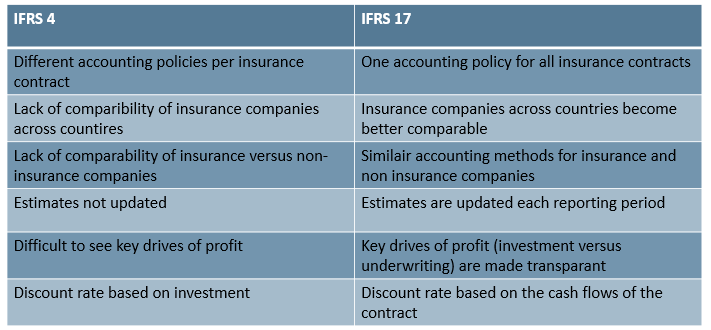

IFRS standards are established in order to have a common accounting language, so business and accounts can be understood and compared from company to company and from country to country. IFRS 4 explains how to disclose insurance contracts, but to put it simple, there are too many issues with IFRS 4 to make a good comparisement among insurance companies and to compare an insurance company to a non-insurance company, therefore IFRS 17 is needed. This gives a basis for users of financial statements to assess the effect that insurance contracts have on the entity’s financial position, financial performance and cash flows.

Why are there issues?

IFRS 4 was introduced in 2004 and was meant to be an interim standard, so there were limited changes to existing insurance accounting practices. Insurance companies were still able to measure similar insurance contracts with different accounting policies. These practices evolved based on specific insurance contracts in a specific country, which also resulted into a deviation between accounting models used by the insurance industry and IFRS standards applied by other industries. This results in limited comparison possibilities between insurance and non-insurance sectors.

How does IFRS 17 solve this?

IFRS 17 requires companies to measure insurance contract on updated estimates and assumptions which reflects timing of cash flows (the discount rate) and the uncertainty of insurance contracts (the risk adjustment). Insurers need to indicate the expected (yet unearned) profit with the CSM, and only recognize the profit when it delivers the insurance service. This is in line with other industries, for example a factory makes a profit when he delivers a good, not earlier. All this information will make it easier to evaluate the performance of insurers against each other, over time and among industries!

What could still be a challenge?

This all sounds great, but there are a few pitfalls; firstly it will cost a lot of money to implement, as data needs to be administrated on lower level, there are changes in way of working, changes in reporting etc. (I explain this in more detail here – impact artike). Another potential issue is that IFRS 17 is principle based. So the principles are the same among insurance companies, everyone can still make their own decision how exactly to measure insurance contracts, so exact comparisement is probably still not possible, so maybe already time for a new IFRS?