Insurance companies who currently disclose under IFRS need to implement the new accounting standards; IFRS 9 and IFRS 17. In this article I will explain why these new accounting standards are needed, summarize their meaning and clarify the main implementation challenges.

What is IFRS?

The goal of IFRS is to provide a global framework for how organizations (mostly listed firms) should prepare and disclose their financial statements. This is done in order to help stakeholders (including investors) with efficient information disclosures. IFRS 17 and IFRS 9 also serve this purpose but they focus both on specific topics; IFRS 17 on the insurance contracts and IFRS 9 on the financial instruments.

What is IFRS 17?

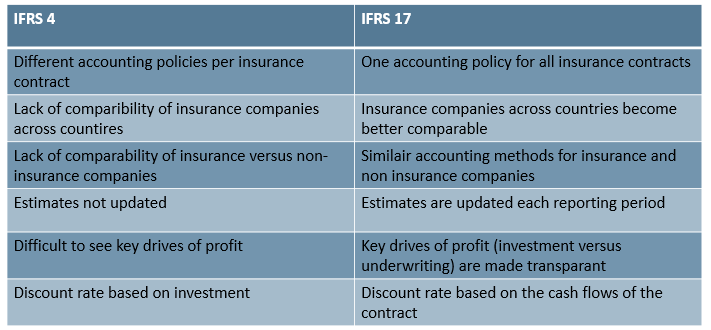

IFRS 17 explains how you should account for insurance contracts and the connected events. Currently this is explained within IFRS 4, but there are several problems with IFRS 4. Within IFRS 4 it is hard to compare profitability between insurance companies and between an insurance company and companies within other industries. This is mainly because with IFRS 4 insurance companies can use old parameters for calculating their financial results and positions while they can also take a profit when the product (the insurance coverage) is not yet delivered. Another problem with IFRS 4 is that the real profit drivers are not visible.

IFRS 17 deals with these problems; insurance companies need to consistently update their estimates, take correct time and risk effects into account and insurers need to present the drivers behind the profits and also risks more transparently. The standard also forces insurance companies to connect profits to the period in which the coverage is given. To understand this more in detail, you can read this article.

What is IFRS 9?

IFRS 9 explains the classification and the measurement of financial instruments. Hence IFRS 9 helps to improve the information disclosure around financial instrument. Many perceived the information disclosure around financial instruments during the financial crisis as inaccurate. In short, impairments on financial instruments were taken too late and the amounts were too little.

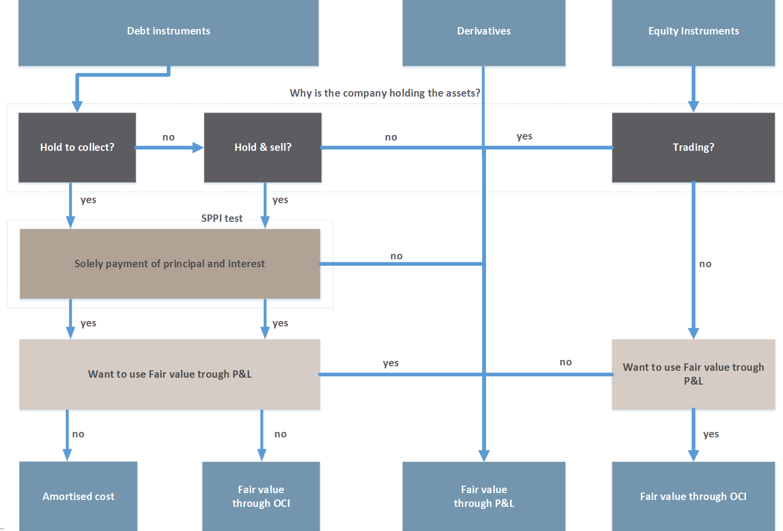

IFRS 9 makes the classification of each financial instrument more logical and principal based. There are two questions which need to be answered for the classification:

- Why is the company holding the asset; just for collecting the cash flows from the underlying asset, or is the asset also held for trading?

- What kind of asset is the financial asset? Is it a derivative, an equity or a debt instrument? With the SPPI (solely payment of principal and interest) model it can be tested whether an instrument is really a debt instrument.

The classification determines which accounting principle is used; should the instrument be measured at fair value or at amortized cost and whether earnings and losses should go through the profit and loss account or through the OCI (other comprehensive income) account.

IFRS 9 also includes a more dynamic credit loss model instructing when an insurer should take an impairment on financial assets. The model is forward looking thereby also expected future losses should be taken into account with the impairment. IFRS 9 makes also the hedge accounting possibilities more rule based, thereby being in line with how risks are being managed within insurers.

Why are IFRS 9 and IFRS 17 implemented together?

The insurance liability (IFRS 17) is always closely connected to the financial instruments (IFRS 9) within insurers. When a client buys an insurance, the insurance liability is created and with the paid premiums are financial instruments bought. Insurers want to reduce the volatility in their earnings and there are some choices within IFRS 9 and IFRS 17 which they can make which can impact the volatility. Under IFRS 17 insurers can decide whether results of changing financial risk assumption go through OCI or through the profit and loss account. Under IFRS 9 insurers can decide whether changes in equity will go through profit and loss or through OCI. Both standards will impact earning volatility and hence balance sheet management choices are connected. Consequently the IFRS board decided it is better if insurers are granted the option to implement both standards together.

Impact:

There is a huge impact on insurers. There is a big change in the disclosure. Ninety percent of the asset and liability side is hit by the combination of IFRS 9 and IFRS 17. Also new concepts and terms are introduced. The standards will also have an impact on the presented numbers itself. Under IFRS 17 the insurance liability needs to be based on updated assumptions which is currently not the case. Also more data is needed. Data is needed with lower granularity and with more history which challenges internal data quality and IT performance. Reporting time lines are also shortened both challenging the systems but also the cooperation between different departments.

Need help?

Overall an interesting change within the area of finance and IT. This was just a short introduction, but if you need help or want to chat about this topic let me know!

Best

Timo Hogendoorn